1970’s

Our challenges included:

| Challenge | So We Developed |

|---|---|

| Reach the president of each “not-for-sale” company discovered | “Enticing Message” methodology allows us to reach almost any “elusive executive” |

| Develop a full report on the company from its President | “Lock On Telephoning” technique gets contacts to open up, but could motivate owners to at least consider being acquired even as they adamantly declared their company was “not-for-sale.” |

| Pinpoint the best acquisition candidates | “BRiC Theory” model for segmenting industries (Interviewing all the experts within a given cluster of direct Business Rivals & Customers to provide a unique understanding of the relevant market.) |

We brought home forty-three acquisitions, made by such clients as Celanese (3 acquisitions), McGraw-Hill (2), Thiokol Chemical (2), and McCormick & Company (1).

1980’s

BRiC Study

In the early 1980’s our business evolved from “finding” acquisition candidates to “analyzing” acquisition candidates. We obtained both quantitative and underlying qualitative information to provide our clients with unique insight. This included:

- comparative data from similar companies

- assessments of performance from customers & vendors

- opinions on the market outlook, threats, opportunities, & suggestions from all

The success of our interviewing techniques and market segmentation methods created demand for a broader range of applications. Among other things, clients asked us to:

- help them gain market share in existing markets

- assess the viability of entering new markets

- increase customer loyalty within their account bases

By 1986 we started obtaining client feedback and quality ratings of our own performance. Harlan did this personally, on every study (and still does). We grew from $550,000 in annual sales in 1982 to $2,500,000 and 25 consultants on staff by 1990.

1990’s

Excitement Quality

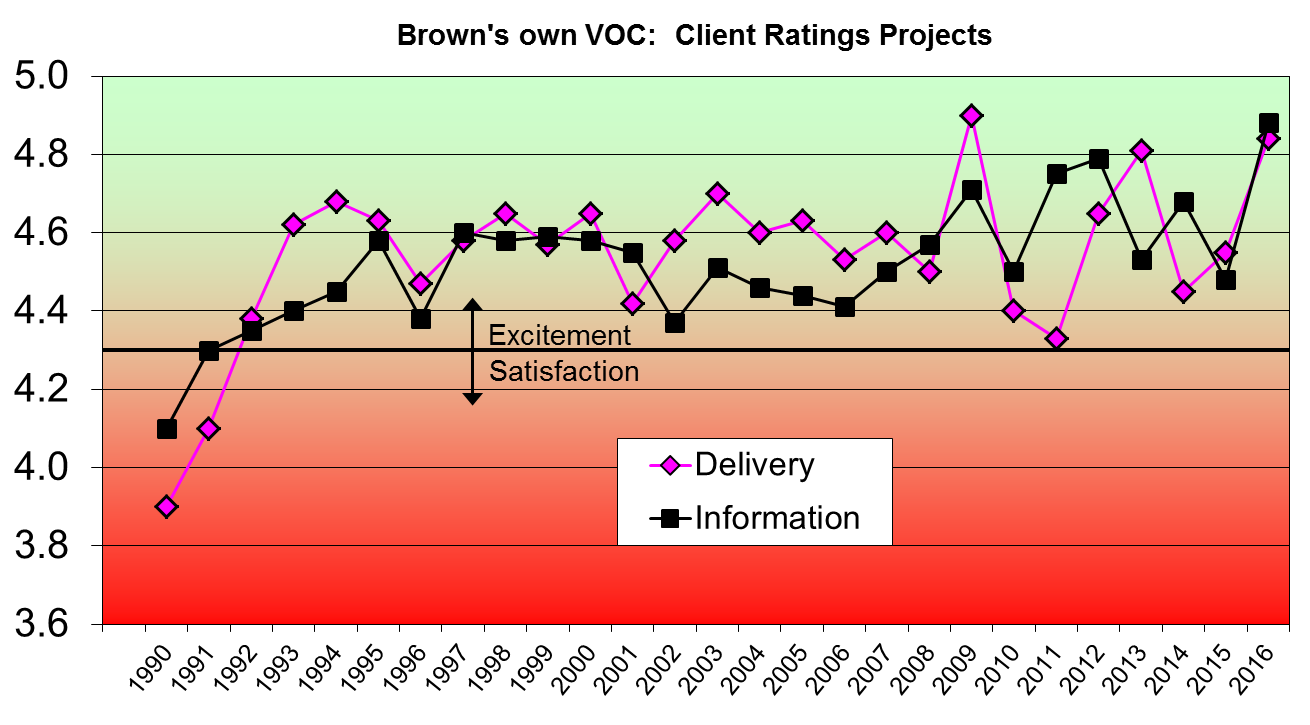

From years of client ratings we were able to plot their meaning:

| Rating # Range | Rating Definition |

| 1=Terrible, 5=Best Possible | |

| 4.4 or higher | Excited — outstanding/best in class/high loyalty |

| 4.1 to 4.3 | Very Satisfied, but not ‘jumping up and down’ |

| 3.6 to 4.0 | Satisfied, but improvement needed |

| 3.0 to 3.5 | Barely satisfied, dissatisfied in one or more areas |

| Below 3.0 | Dissatisfaction |

Our study quality was at the “satisfaction” level. We went through training in Dr. W. Edwards Deming’s philosophy for constant process improvement and realized that we needed to make changes to our system in order to average “Excitement” level.

Our study producers were primarily graduates of University of Virginia, Duke, Princeton, Yale, and William & Mary. They typically worked for 3 years, then left to pursue an MBA. As talented as they were, it became obvious that the study quality ratings depended on the relative seniority of the actual producers.

Through statistical charting and brainstorming, an astonishing but simple way to reach Excitement Quality leaped out at us:

- become a smaller organization of very senior BRiC Study people committed to produce BRiC studies for their clients for their careers

- become absolutely the world’s “best in class” at getting “underlying information” from clients’ customers

Our officers decided to reorganize for the sake of long term quality, which also allowed them to:

- achieve more independence

- work from a super outfitted home office

- live wherever they wanted, leaving the daily Northern Virginia commute to others

This pleasantly surprised Harlan, who had reached the point in his career and age where he was setting up an ESOP sale of the company to the employees. It looked like he would “work for a few more years, and retire.” But Harlan decided that although he did want to change his routine of the previous 35 years, he did not want to retire, ever.

So the change was made with three-year notices to employees.

Harlan’s title changed from CEO to Chief Excitement Quality Officer.

Since 1994 our Senior Project Managers have been career committed and are now incorporated licensees of Harlan Brown & Company, Inc. The benefit for our clients can be seen in the average of our study ratings since that time:

2000’s

Excitement Quality Studies, Telephone Participation Training

Our study process continues to improve with the direction and encouragement provided by our clients, including our participation in planning sessions inputing our objective and customer oriented viewpoints. We have added “supplier perception” studies to assess how well clients manage their supply chains, and we see an increase in study updates that allow clients to track their progress compared to benchmarks identified in previous studies.

We also now offer training in our core competence, the Art & Science of Telephone Participation, starting with the book Five Enticing Messages available on Amazon, plus on-line training programs on our technique.